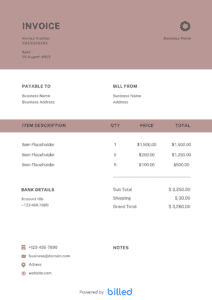

Bakery Invoice Template

The bakery invoice template from Billed streamlines your billing process, helping bakery owners create professional invoices quickly and efficiently.

Get Your Free Bakery Invoice Template

The food industry and bakery industry in specific are becoming competitive day by day. To keep up with the competitors, bakeries and baking businesses need to be organized.

Bakeries need to manage their finances efficiently to survive and thrive, and professional Invoices can help them do that.

Professional invoices ensure that bakeries are paid faster for cakes, bagels, donuts, and other baking services.

At Billed, we have created free bakery invoice templates with bakeries in mind. These templates can help you in getting paid quickly for your products and help you organize your finances.

These customizable and professional invoice templates are available in Word, Excel, PDF, Google sheets, and Google Docs formats.

Download the free bakery invoice template to get started.

Bakery Delivery Invoice Template

Simplify billing for your bakery’s delivery services using this template. It includes fields for delivery details, allowing you to efficiently create invoices with accurate delivery information for better tracking and management.

Download For:

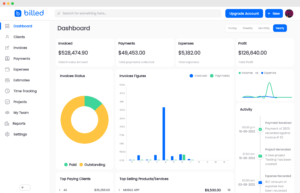

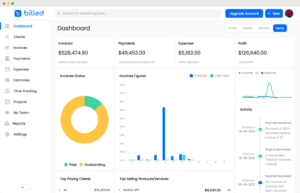

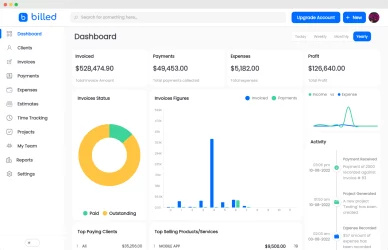

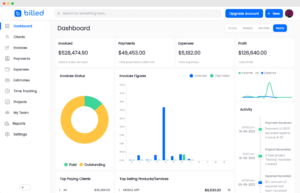

Invoice With Billed

Accept online payments on your invoices to get paid faster.

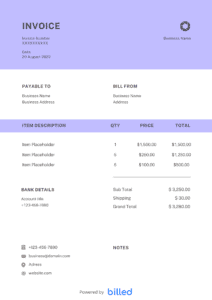

Invoice With Billed

Accept online payments on your invoices to get paid faster.

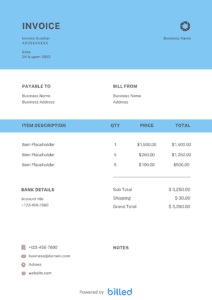

Invoice With Billed

Accept online payments on your invoices to get paid faster.

- What is Bakery Invoice Used For?

- Benefits Of using Bakery Invoice Template

- What are Invoice Types For Bakeries?

-

Who needs to use Bakery Invoice?

- What to include on a bakery invoice

- When is the right time to send an invoice to your bakery customers?

- How to Create a Bakery Invoice?

- Some Other Templates

-

Download a Bakery Invoice Template for Free

What is an Invoice Used for?

A bakery invoice is a document used in a bakery business for several purposes. It serves as a record of the products or services provided to customers and outlines the details of the transaction. Here are some key uses and benefits of a bakery invoice:

Billing Customers: A bakery invoice is primarily used to bill customers for the products they have purchased or the services they have availed. It includes itemized lists of the bakery items, quantities, prices, any applicable taxes, and any additional charges. This helps ensure accurate billing and provides transparency to customers regarding the cost breakdown.

Tracking Sales and Revenue: Bakery invoices are crucial in tracking sales and revenue for the bakery business. By maintaining a record of each transaction, including invoice details, the business can monitor its financial performance and keep track of the revenue generated from various products or services.

Customer Communication: Invoices serve as a means of communication between the bakery and its customers. They provide important information such as the bakery’s contact details, payment terms, and special instructions. Clear and well-organized invoices help establish professionalism, reinforce brand identity, and build customer trust.

Financial Records and Bookkeeping: Bakery invoices contribute to maintaining accurate financial records and streamlining bookkeeping processes. They provide essential documentation for tracking income, expenses, and tax obligations. Having well-documented invoices makes reconciling accounts, preparing financial statements, and fulfilling reporting requirements easier.

Dispute Resolution: In case of any discrepancies or disputes, bakery invoices serve as supporting evidence for resolving customer issues. The detailed information included in the invoice, such as product descriptions, quantities, and prices, helps address any concerns and reach a fair resolution.

Using our bakery invoice template, you can enjoy additional benefits such as saving time and effort in creating invoices, ensuring a professional and consistent format, and maintaining organized records for future reference.

Benefits Of using Bakery Invoice Template

Running a bakery business without an invoice template means you have to spend much time designing and creating invoices.

By using the free bakery invoice template, you will have more time to spend on the things you love.

The bakery invoice template has several benefits, some of which are as follows.

- You can customize the bakery invoice template according to your needs.

- Fast payment processing on all orders

- It as an effective way to record orders and transactions.

- You can save this template in multiple formats.

- It captures all the required information for an invoice.

- Bill client and get paid without any delay.

What are Invoice Types For Bakeries?

There are various types of invoices for bakeries, including:

Retail Bakery Invoice: Used for sales made directly to customers at a bakery shop or retail outlet. It contains details of the products purchased, quantities, prices, and any applicable taxes.

Home Bakery Invoice: Specifically designed for home-based bakeries, this invoice is used for billing customers for homemade baked goods. It typically includes itemized lists of products, quantities, prices, and additional charges.

Cake Bakery Invoice: Used for orders related to custom cakes, this invoice type includes specific details such as cake design, size, flavors, and any customization requests. It may also include additional charges for unique decorations or delivery.

Wholesale Bakery Invoice: Designed for bakery businesses that supply their products to other businesses or establishments, this invoice type includes bulk orders and wholesale pricing. It provides information on the products, quantities, unit prices, and discounts or terms applicable to wholesale transactions.

Doughnut & Cupcakes Bakery Invoice: Specifically tailored for bakeries specializing in doughnuts and cupcakes, this invoice type lists the specific items ordered, quantities, individual prices, and any additional charges. It may also include customization details and delivery information if applicable.

No matter what sort of bakery you have, you can use our invoice template to look professional and get paid faster.

Check our stylish and customizable catering invoice template.

Who needs to use Bakery Invoice?

Bakery invoices are primarily used by bakeries or businesses that operate in the baking industry. These invoices serve as a formal document for recording the sale of bakery products and requesting payment from customers. Bakeries of all sizes, from small local shops to large commercial bakeries, use bakery invoices to streamline their billing processes and maintain accurate financial records.

Here are some key entities that need to use bakery invoices:

Bakeries: Bakeries must use invoices to bill their customers for the products they purchase, whether it’s bread, cakes, pastries, cookies, or other baked goods.

Wholesale Distributors: Companies that distribute bakery products to various retail outlets, grocery stores, or restaurants may also use bakery invoices to bill their customers for the products they supply.

Catering Businesses: Caterers who offer bakery products as part of their services, such as wedding cakes or dessert options, use bakery invoices to bill their clients.

Online Bakeries: E-commerce bakeries that sell baked goods online and ship them to customers use bakery invoices for order fulfilment and payment tracking.

Speciality Cake Shops: Businesses specialising in custom cakes for birthdays, weddings, and other celebrations use bakery invoices to bill their customers for their unique creations.

Bakery Suppliers: Companies that supply ingredients, equipment, or packaging materials to bakeries may also use bakery invoices to charge their clients for their products.

To run a bakery or baked food business is not a piece of cake. Active and efficient administration is the key to the success of any business.

Invoices play a vital role in the whole process of business success. Billed has structured professional bakery invoices that empower bakers to record their orders and sales appropriately.

What to include in Bakery Invoice?

A bakery invoice should include specific details related to the sale of bakery products and services. It is a formal transaction record and provides essential information to the customer and the bakery. Here’s what to include in a bakery invoice:

Invoice Header:

- Bakery Name: The name of your bakery or business.

- Logo: Your bakery’s logo for brand identification (optional).

- Contact Information: Your bakery’s address, phone number, and email.

Invoice Number:

- A unique identification number for the invoice. This helps in tracking and organizing your invoices.

Invoice Date:

- The date when the invoice is issued.

Due Date:

- The date by which the payment is expected from the customer. This helps set payment terms.

Customer Details:

- Customer’s Name: The name of the individual or business being billed.

- Customer’s Address: The billing address of the customer.

Description of Bakery Products and Services:

- Itemized List: Provide a detailed list of the bakery products or services provided. Include the name of each product or service, quantity, and unit price.

Subtotal:

- Calculate the subtotal by multiplying the quantity of each item by its unit price.

Taxes and Fees:

- If applicable, include taxes (e.g., sales tax, VAT) and other fees (e.g., delivery charges).

Total Amount Due:

- Sum up the subtotal and any applicable taxes/fees to arrive at the total amount the customer needs to pay.

Payment Terms and Methods:

- Outline the payment terms, including the accepted payment methods (e.g., cash, credit card, online payment) and any specific payment instructions.

Terms and Conditions:

- Include any relevant terms and conditions related to the sale, such as refund policies, exchange policies, or specific terms for custom orders.

Notes or Additional Information:

- Provide additional information or special notes relevant to the invoice or the products/services.

Remember to make the invoice professional, clear, and easy to read. Using invoice templates from Billed can help you streamline the process and ensure accuracy in your bakery’s financial documentation.

When is the right time to send an invoice to your bakery customers?

The right time to send an invoice to your bakery customers is typically after the goods or services have been provided. However, the specific timing can vary depending on different factors, like the nature of the order, your business policies, and the agreement with the customer.

Sometimes, it may be appropriate to send the invoice immediately after the customer receives their baked goods or when the service is completed. This ensures that the invoice aligns with the timing of the transaction and allows customers to review the details while the experience is still fresh in their minds.

On the other hand, for larger or more complex orders, send the invoice in advance or request a partial payment upfront. This approach helps secure the order and ensures customers are committed to purchasing.

Ultimately, finding a balance that works for your bakery and your customers is important. Clear communication and setting expectations regarding invoice timing help avoid confusion or delays in the payment process, ensuring a smooth and efficient transaction for both parties involved.

How to Create a Bakery Invoice?

Creating an accurate and detailed invoice with our bakery invoice template is quick and easy. Here’s a step-by-step guide to get you started:

Download the template: Download the free bakery invoice template from Billed.

Add company details: Include your business name, logo, address, cell number, email address, and other relevant information. These details generally appear at the top of the invoice.

Enter clients’ details: Add the details of the client you are billing. Include their name, address, and any other necessary contact details. Double-check the accuracy of the client’s details.

Assign an invoice number: Generate a unique invoice number for this specific invoice. Place the invoice number prominently on the invoice for reference purposes.

Invoice issue and expiry date: Indicate when the invoice is issued and specify the payment due date or expiry date. This provides a clear timeline for the client to make the payment.

Line items: List the services or products provided in separate line items. Include each line item’s description, quantity, and subtotal. This breakdown allows the client to understand the specifics of the invoice and ensures transparency.

Subtotals and taxes: Calculate the subtotal by adding the line item totals. If applicable, include any taxes or additional charges. This information provides a clear overview of the costs involved.

Total amount: Calculate the amount due by adding the subtotal and any taxes or additional charges. Display this total prominently on the invoice to communicate the amount the client needs to pay.

Terms and conditions: Specify the payment terms and conditions, such as the accepted payment methods and any late payment penalties or early payment discounts. Include this information in a separate section or at the bottom of the invoice.

Save and send: Save the completed invoice with an exact file name for easy retrieval. If sending the invoice electronically, attach it to the email and send it. Alternatively, you can print the invoice and mail it to the client if preferred.

Download a Bakery Invoice Template for Free

Make your billing process easy and faster with our free Bakery Invoice Template. This user-friendly template is designed to help you create professional invoices effortlessly, saving you time and ensuring accurate billing for your bakery business. Download it now and simplify your bakery’s invoicing tasks.